“The Power of Credit: How Financing Fueled the Rise of Premier Equestrian”

Heidi Zorn, President of Premier Equestrian, knows firsthand the transformative impact that strategic financing can have on an equestrian business. In the very beginning, when she and co-founder Mark Neihart were just starting out, not one bank or government program was willing to take a chance on financing their fledgling company.

“The only opportunity that was available to us was American Express,” Zorn recounts. “With a high-limit credit card from American Express, we were able to buy a modest amount of inventory and set up a retail shopping cart website. Without this initial infusion, there would not be a Premier Equestrian today.”

Zorn’s story underscores the vital role that credit can play in empowering entrepreneurs and turning dreams into reality. Even when traditional financing avenues were closed off, the flexibility and accessibility of credit cards allowed her to lay the foundation for the thriving company Premier Equestrian has become.

Premier President Heidi Zorn at the Desert International Horse Park’s Premier Week

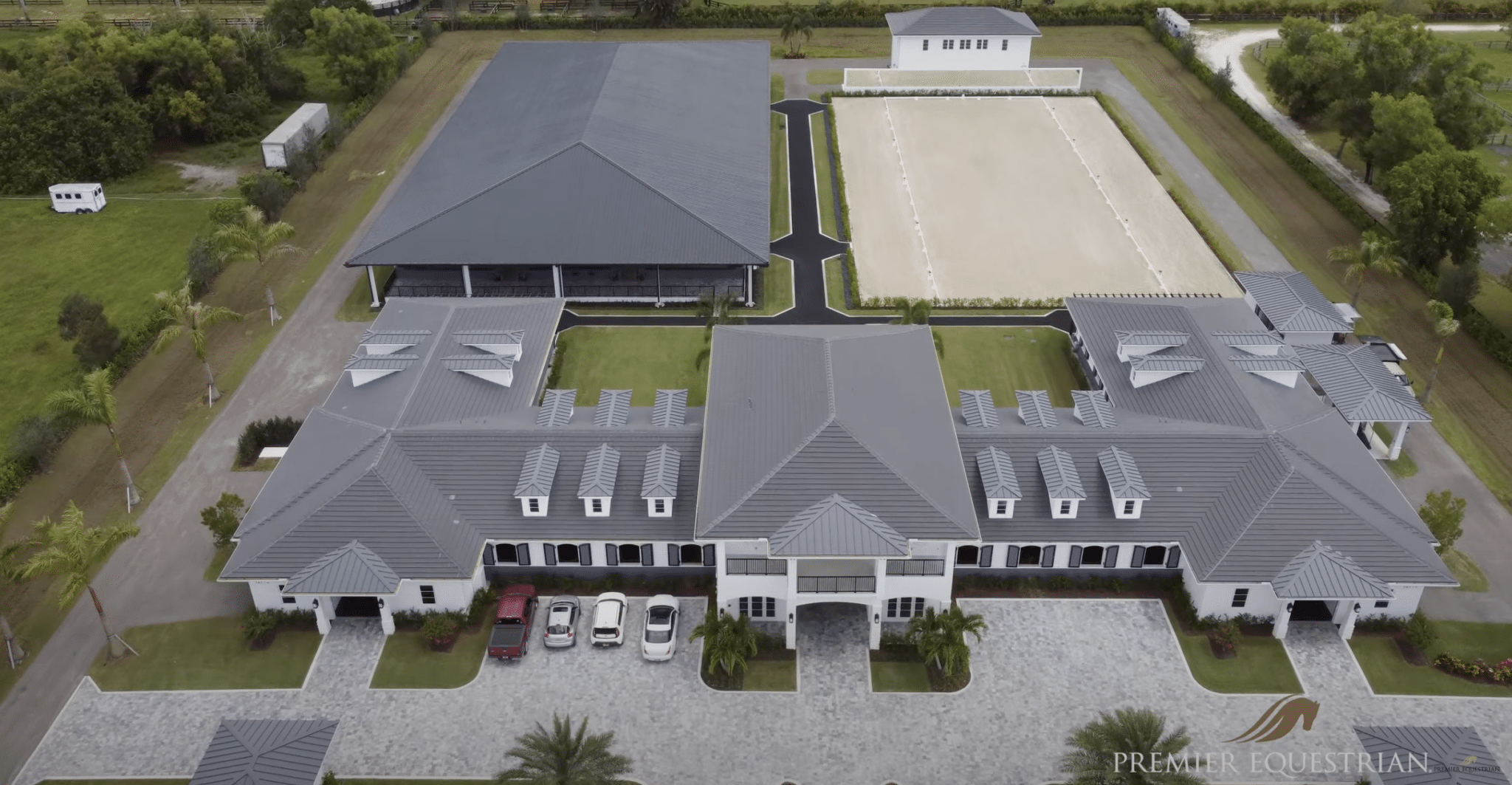

New Premier Equestrian Warehouse and offices built in 2024

Premier Equestrian CEO Chris Neihart & Heidi Zorn in the new warehouse 2024

Co-founder/Partner Mark Neihart

But credit has proven invaluable for Zorn’s personal equestrian pursuits as well. “At one point, when my horse went lame, buying a replacement was almost impossible if it hadn’t been for Bank of America’s 0% credit card for 18 months,” she explains. “Yes, I bought my horse Primo on a credit card, and he has turned out to be the best horse I have ever had, I have no regrets.”

Zorn’s experiences underscore the power of leveraging financing to support both business and personal equestrian endeavors. By strategically utilizing credit cards and other lending options, she has been able to make critical investments, seize opportunities, receive special perks and travel miles and ultimately elevate her business and equestrian operations to new heights.

For aspiring equestrians and business owners alike, Zorn’s story serves as a powerful testament to the transformative potential of financing. With the right approach and a clear understanding of the available options, credit can be a valuable tool in realizing your equestrian dreams.

Zorn and Premier Equestrian mascot Sir Primo

“Leveraging Financing to Elevate Your Equestrian Endeavors”

The costs of maintaining a farm, acquiring quality equipment, and investing in top-tier horses can quickly add up. However, contrary to popular belief, financing these essential elements of your equestrian lifestyle can actually be a smart and strategic move.

Far from a necessary evil, leveraging financing options can open up a world of possibilities for the passionate horse owner. Whether you’re looking to upgrade your arena footing, purchase a new tractor or grooming equipment, or bring home that dream horse, the right financing plan can help you achieve your goals without depleting your entire savings.

“Financing allows you to make strategic investments in your equestrian operation without having to deplete your cash reserves,” explains our financial advisor. “By spreading the cost over time, you can free up capital to reinvest in other areas of your business or personal life.”

Premier Equestrian has some financing options to help move that dream along.

US Bank Offers

For more information contact representative Hunter Liu 385-261-4493 hunter.liu@usbank.com

• Low intro APR for 18 billing cycles with no annual fees

• 0% Into APR and One-time cash back sign-up bonus, no annual fees

Business Quick Loan – Achieve your business goals with a loan or line of credit

Low interest Rate, Terms up to 5 years, Up to $100k without collateral, No application fees

Of course, it’s important to do your due diligence and carefully evaluate the terms and conditions of any financing agreement. Work closely with your lender to ensure you’re getting the best possible rates and terms,and always have a plan in place for making timely payments.

With the right financing strategy, the sky’s the limit when it comes to elevating your equestrian endeavors. Whether you’re looking to upgrade your arena, purchase a new tractor, or bring home that dream horse, leveraging financing can help you get there without sacrificing your financial stability.

So, don’t let the upfront costs of equestrian ownership hold you back. Explore the financing options available and unlock the full potential of your farm, equipment, and herd. Your equine partners will thank you for it.

For more information and additional options for financing, visit these links